British Heritage

Remember, Cherish, Learn.

beta

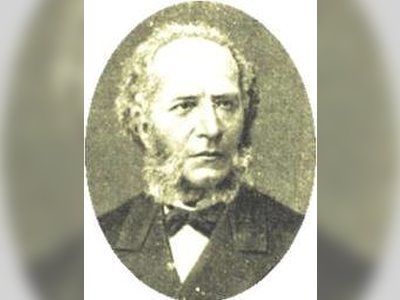

John Law - The First Paper Money Banker, 1720

The First Paper Money Banker and an Architect of Modern Economics.

John Law (1671 – 1729) was a noteworthy Scottish economist who significantly influenced the field of finance in the 18th century. Today, he is remembered primarily for the key role he played in establishing paper money as a means of economic exchange. Law's legacy continues to impact not only the British heritage but the world's economic understanding, offering crucial insights into the complexities of finance and commerce.

Born into a family of Lowland Scots bankers and goldsmiths, Law exhibited an uncanny ability to calculate odds - a talent that would earn him a reputation as an accomplished gambler. Despite his unconventional pastimes, Law studied banking in detail, following in his family's footsteps. His early years were punctuated by both success and scandal, including a murder charge for a duel over a love interest. After escaping from prison, Law left for Amsterdam, marking the beginning of his international adventures.

Law's primary contributions to economic thought revolve around his distinctive approach to money and national wealth. He strongly advocated for the use of paper money over metal, considering it a superior form of currency. This notion was radical for its time, challenging the conventional wisdom that viewed gold and silver as the bedrock of economic value. Law also championed the creation of a national bank as a means to stimulate the economy.

His key economic theories included the scarcity theory of value and the real bills doctrine, both of which continue to be referenced in modern economic discussions. The scarcity theory of value proposed that the value of goods was primarily a result of their availability, a novel concept that helped shift economic thought away from labor-based theories of value. The real bills doctrine, meanwhile, argued for tying the money supply to the needs of trade, thereby minimising inflation.

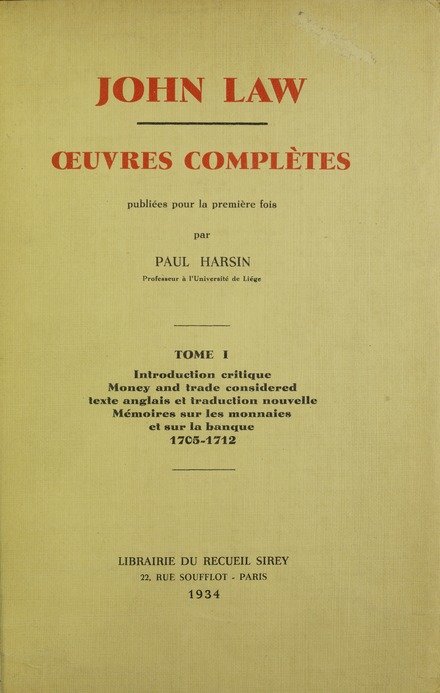

Law's ideas received their most significant test in France, where he founded the Banque Générale in 1716. This private bank, predominantly funded by Law and Louis XV, was later nationalised and renamed the Banque Royale. With three-quarters of its capital consisting of government bills and government-accepted notes, it effectively served as France's first central bank.

The establishment of this bank marked a pivotal moment in the history of banking, as it was among the first few banks to issue paper money, joining the ranks of Sweden, England, Holland, Venice, and Genoa. This move was a direct application of Law's belief in paper money as a preferable medium of exchange.

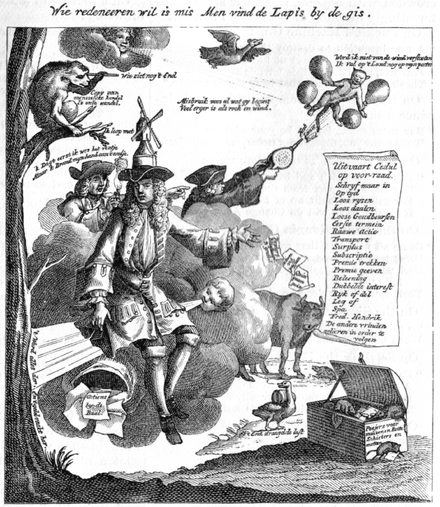

Simultaneously, Law also established the Mississippi Company, a venture that would earn him a notorious place in economic history. The company's stock value escalated rapidly, reminiscent of the contemporary tulip mania in Holland. However, in 1720, the bubble burst, leaving the Mississippi Company's shares worthless and causing economic chaos. The resulting crisis has since been known as the Mississippi Bubble, a stark reminder of the potential pitfalls of economic speculation.

Despite the disastrous collapse of the Mississippi Company, it's worth noting that Law's time in France was not without positive achievements. He introduced several beneficial reforms, including efforts to break up large landholdings for the benefit of peasants, the abolition of internal road and canal tolls, and initiatives to promote new industries.

Law's downfall was as swift as his rise. Fleeing from France amidst the market panic, he spent the remaining years of his life wandering through Europe, a shadow of his former prosperity. Despite his personal misfortune, however, his theories on monetary policy have endured. They have been crucial to our modern understanding of economics, and his radical idea of a national bank issuing paper money has become a cornerstone of present-day financial systems.

Law's impact on the British heritage is multifaceted. As a Scot, his pioneering work in the field of economics reflects the intellectual contribution of Scotland to the world. His ideas were precursors to subsequent banking systems, including the Bank of England, and his intellectual legacy continues to resonate in British economic thought.

John Law's life and career also serve as a cautionary tale about the dangers of financial speculation. His role in the Mississippi Bubble has provided generations of economists and financiers with critical insights into the dynamics of financial crises. In a broader cultural context, his life - marked by scandal, innovation, success, and failure - offers a compelling narrative that has inspired interpretations in film and literature.

In conclusion, John Law's influence on British heritage is considerable and enduring. As a figure of immense historical importance, he is remembered both for his revolutionary ideas about finance and economics and for his role in one of history's most notorious financial crises. His life and work serve as a testament to the profound impact that individual visionaries can have on the course of history, shaping not just the economies of their own times, but the economic understanding of generations to come.

From Gambler to Economist: The Formative Years

Born into a family of Lowland Scots bankers and goldsmiths, Law exhibited an uncanny ability to calculate odds - a talent that would earn him a reputation as an accomplished gambler. Despite his unconventional pastimes, Law studied banking in detail, following in his family's footsteps. His early years were punctuated by both success and scandal, including a murder charge for a duel over a love interest. After escaping from prison, Law left for Amsterdam, marking the beginning of his international adventures.

Revolutionising Financial Thinking: Law's Economic Contributions

Law's primary contributions to economic thought revolve around his distinctive approach to money and national wealth. He strongly advocated for the use of paper money over metal, considering it a superior form of currency. This notion was radical for its time, challenging the conventional wisdom that viewed gold and silver as the bedrock of economic value. Law also championed the creation of a national bank as a means to stimulate the economy.

His key economic theories included the scarcity theory of value and the real bills doctrine, both of which continue to be referenced in modern economic discussions. The scarcity theory of value proposed that the value of goods was primarily a result of their availability, a novel concept that helped shift economic thought away from labor-based theories of value. The real bills doctrine, meanwhile, argued for tying the money supply to the needs of trade, thereby minimising inflation.

The Banque Générale: France's First Central Bank

Law's ideas received their most significant test in France, where he founded the Banque Générale in 1716. This private bank, predominantly funded by Law and Louis XV, was later nationalised and renamed the Banque Royale. With three-quarters of its capital consisting of government bills and government-accepted notes, it effectively served as France's first central bank.

The establishment of this bank marked a pivotal moment in the history of banking, as it was among the first few banks to issue paper money, joining the ranks of Sweden, England, Holland, Venice, and Genoa. This move was a direct application of Law's belief in paper money as a preferable medium of exchange.

The Mississippi Company and the Infamous Bubble

Simultaneously, Law also established the Mississippi Company, a venture that would earn him a notorious place in economic history. The company's stock value escalated rapidly, reminiscent of the contemporary tulip mania in Holland. However, in 1720, the bubble burst, leaving the Mississippi Company's shares worthless and causing economic chaos. The resulting crisis has since been known as the Mississippi Bubble, a stark reminder of the potential pitfalls of economic speculation.

Despite the disastrous collapse of the Mississippi Company, it's worth noting that Law's time in France was not without positive achievements. He introduced several beneficial reforms, including efforts to break up large landholdings for the benefit of peasants, the abolition of internal road and canal tolls, and initiatives to promote new industries.

A Legacy Etched in History

Law's downfall was as swift as his rise. Fleeing from France amidst the market panic, he spent the remaining years of his life wandering through Europe, a shadow of his former prosperity. Despite his personal misfortune, however, his theories on monetary policy have endured. They have been crucial to our modern understanding of economics, and his radical idea of a national bank issuing paper money has become a cornerstone of present-day financial systems.

Law's impact on the British heritage is multifaceted. As a Scot, his pioneering work in the field of economics reflects the intellectual contribution of Scotland to the world. His ideas were precursors to subsequent banking systems, including the Bank of England, and his intellectual legacy continues to resonate in British economic thought.

John Law's life and career also serve as a cautionary tale about the dangers of financial speculation. His role in the Mississippi Bubble has provided generations of economists and financiers with critical insights into the dynamics of financial crises. In a broader cultural context, his life - marked by scandal, innovation, success, and failure - offers a compelling narrative that has inspired interpretations in film and literature.

In conclusion, John Law's influence on British heritage is considerable and enduring. As a figure of immense historical importance, he is remembered both for his revolutionary ideas about finance and economics and for his role in one of history's most notorious financial crises. His life and work serve as a testament to the profound impact that individual visionaries can have on the course of history, shaping not just the economies of their own times, but the economic understanding of generations to come.

- John Law (economist)en.wikipedia.org