British Heritage

Remember, Cherish, Learn.

beta

David Ricardo - Advocate for Central Banking 1824

Contribution of David Ricardo to British Heritage

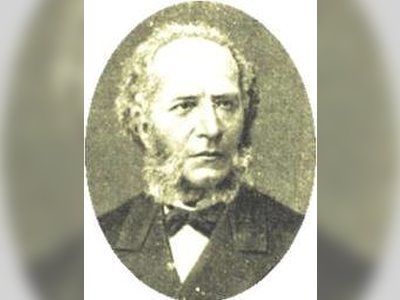

David Ricardo, born on 18th April 1772 in London, was a British political economist who left a lasting legacy on economic thought. Alongside other influential classical economists such as Thomas Malthus, Adam Smith, and James Mill, Ricardo's ideas shaped the foundation of modern economics. His contributions to British heritage lie not only in his economic theories but also in his political influence as a member of the Parliament of Great Britain and Ireland. Ricardo's advocacy for free trade, central banking, and the repeal of protectionist laws significantly impacted the economic policies of his time and laid the groundwork for future economic reforms in Britain.

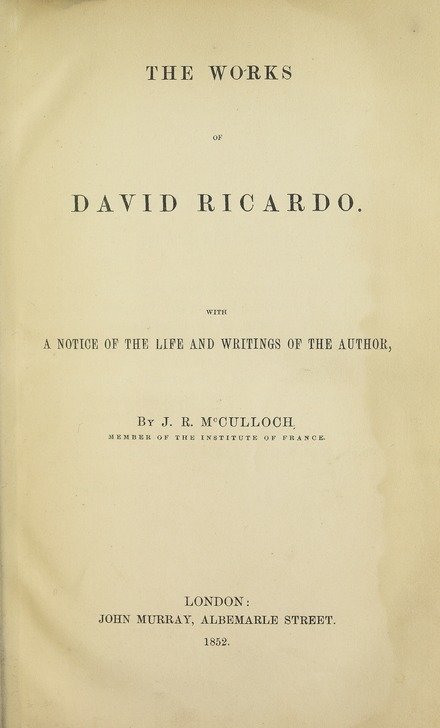

David Ricardo's impact on economics is profound, and his legacy endures to this day. His most famous work, "Principles of Political Economy and Taxation," published in 1817, presented groundbreaking ideas on value theory, international trade, and economic distribution. Ricardo's formulation of the theory of comparative advantage revolutionized the understanding of international trade and its benefits for countries with different levels of productivity. This theory remains a cornerstone of modern trade economics.

Ricardo's insights on rent, wages, and profits provided essential foundations for understanding economic distribution. He argued that rent is a surplus derived from the productivity of land, wages depend on the cost of living, and profits decrease when real wages increase due to competition between capitalists. These concepts laid the groundwork for further investigations into the distribution of income and wealth in economics.

Moreover, Ricardo's work on central banking and monetary policy significantly influenced economic thought and policy. He advocated for the establishment of a central bank as the issuer of money, and his ideas contributed to the development of modern central banking systems. Ricardo's arguments for free trade and against protectionist policies also shaped economic policies in the decades to come, promoting openness and international cooperation in trade.

David Ricardo's contributions to British heritage were not limited to his economic theories. As a politician and member of the Parliament of Great Britain and Ireland, he actively participated in political debates and advocated for reforms that aimed to enhance the well-being of the nation. Ricardo's stance on free trade and opposition to protectionism helped set the stage for the eventual repeal of the Corn Laws in 1846, which removed tariffs on grain imports and allowed for greater economic growth and efficiency.

His advocacy for central banking and sound monetary policy also played a role in shaping the financial institutions of Britain, laying the groundwork for a stable and resilient banking system that could effectively support economic growth. His emphasis on parliamentary reform and criminal law reform demonstrated his commitment to justice and fairness in society.

Ricardo's intellectual contributions and political engagement made him an influential figure in British society, and his ideas have left a lasting impact on economic thought and policy. His legacy continues to be studied and debated by economists and policymakers worldwide, making him a significant figure in the history of British heritage.

David Ricardo's success as an economist and politician can be attributed to his astute understanding of economic principles and his ability to translate theoretical concepts into practical policy proposals. Born into a Sephardic Jewish family of Portuguese origin, Ricardo initially worked in his father's successful stockbroking business. However, he later ventured into independent business ventures, notably financing government borrowing during the Napoleonic Wars, which contributed significantly to his wealth and financial success.

Despite not having formal education in economics, Ricardo's intellectual curiosity and passion for learning led him to study and write extensively on economic matters. He published his first economics article at the age of 37, advocating for a reduction in the note-issuing of the Bank of England. His subsequent work, "The High Price of Bullion, a Proof of the Depreciation of Bank Notes," published in 1810, further solidified his reputation as an influential economist.

Throughout his life, Ricardo maintained close friendships with prominent thinkers and reformers, such as James Mill, Jeremy Bentham, and Thomas Malthus. These relationships allowed him to engage in meaningful debates and discussions that enriched his understanding of economic issues and helped shape his own ideas.

Ricardo's untimely death at the age of 51 in 1823 was a loss to the economic and political communities. His contributions to economic theory and his advocacy for progressive reforms continue to be remembered and revered in both academic and policy circles. The principles and theories he developed remain influential in shaping economic thought and informing economic policies in modern times.

In conclusion, David Ricardo's significant contributions to British heritage can be seen in his economic theories that laid the foundation for modern economics. His ideas on comparative advantage, free trade, and central banking continue to be relevant and influential. Moreover, as a politician, Ricardo actively advocated for reforms that promoted economic growth, justice, and fairness. His intellectual legacy endures, making him a key figure in the history of economic thought and policy in Britain.

Legacy of David Ricardo

David Ricardo's impact on economics is profound, and his legacy endures to this day. His most famous work, "Principles of Political Economy and Taxation," published in 1817, presented groundbreaking ideas on value theory, international trade, and economic distribution. Ricardo's formulation of the theory of comparative advantage revolutionized the understanding of international trade and its benefits for countries with different levels of productivity. This theory remains a cornerstone of modern trade economics.

Ricardo's insights on rent, wages, and profits provided essential foundations for understanding economic distribution. He argued that rent is a surplus derived from the productivity of land, wages depend on the cost of living, and profits decrease when real wages increase due to competition between capitalists. These concepts laid the groundwork for further investigations into the distribution of income and wealth in economics.

Moreover, Ricardo's work on central banking and monetary policy significantly influenced economic thought and policy. He advocated for the establishment of a central bank as the issuer of money, and his ideas contributed to the development of modern central banking systems. Ricardo's arguments for free trade and against protectionist policies also shaped economic policies in the decades to come, promoting openness and international cooperation in trade.

Contribution to British Heritage

David Ricardo's contributions to British heritage were not limited to his economic theories. As a politician and member of the Parliament of Great Britain and Ireland, he actively participated in political debates and advocated for reforms that aimed to enhance the well-being of the nation. Ricardo's stance on free trade and opposition to protectionism helped set the stage for the eventual repeal of the Corn Laws in 1846, which removed tariffs on grain imports and allowed for greater economic growth and efficiency.

His advocacy for central banking and sound monetary policy also played a role in shaping the financial institutions of Britain, laying the groundwork for a stable and resilient banking system that could effectively support economic growth. His emphasis on parliamentary reform and criminal law reform demonstrated his commitment to justice and fairness in society.

Ricardo's intellectual contributions and political engagement made him an influential figure in British society, and his ideas have left a lasting impact on economic thought and policy. His legacy continues to be studied and debated by economists and policymakers worldwide, making him a significant figure in the history of British heritage.

Success and General Information about David Ricardo

David Ricardo's success as an economist and politician can be attributed to his astute understanding of economic principles and his ability to translate theoretical concepts into practical policy proposals. Born into a Sephardic Jewish family of Portuguese origin, Ricardo initially worked in his father's successful stockbroking business. However, he later ventured into independent business ventures, notably financing government borrowing during the Napoleonic Wars, which contributed significantly to his wealth and financial success.

Despite not having formal education in economics, Ricardo's intellectual curiosity and passion for learning led him to study and write extensively on economic matters. He published his first economics article at the age of 37, advocating for a reduction in the note-issuing of the Bank of England. His subsequent work, "The High Price of Bullion, a Proof of the Depreciation of Bank Notes," published in 1810, further solidified his reputation as an influential economist.

Throughout his life, Ricardo maintained close friendships with prominent thinkers and reformers, such as James Mill, Jeremy Bentham, and Thomas Malthus. These relationships allowed him to engage in meaningful debates and discussions that enriched his understanding of economic issues and helped shape his own ideas.

Ricardo's untimely death at the age of 51 in 1823 was a loss to the economic and political communities. His contributions to economic theory and his advocacy for progressive reforms continue to be remembered and revered in both academic and policy circles. The principles and theories he developed remain influential in shaping economic thought and informing economic policies in modern times.

In conclusion, David Ricardo's significant contributions to British heritage can be seen in his economic theories that laid the foundation for modern economics. His ideas on comparative advantage, free trade, and central banking continue to be relevant and influential. Moreover, as a politician, Ricardo actively advocated for reforms that promoted economic growth, justice, and fairness. His intellectual legacy endures, making him a key figure in the history of economic thought and policy in Britain.

- David Ricardoen.wikipedia.org